30-sie-2012

The super-majors are hardly moving at the moment ahead of tomorrow's Bernanke speech, but the squeeze in EM currencies continued on position squaring ahead of the "big event".

EURUSD spend another day wandering aimlessly in a tight range and many of the other major currencies saw lacklustre activity today, though GBP impressed with a marginal new 4-day high as of this writing that I am scratching my head over a bit. AUDUSD eased lower to shake hands with its 200-day moving average. It doesn't appear that any one wants to make a dramatic statement until they see the whites of Bernanke's eyes.

In contrast with the sluggish activity in the major currencies, there was solid activity as CEE currencies and other EM currencies remained very weak on what appears to be position squaring ahead of tomorrow's Bernanke speech.

On the data front, we got a horrific Australia building approvals report overnight, signs of a continued creeping rise in Germany unemployment, and a middle-of-the-recent range US jobless claims report (the most interesting season for claims begins later in the fall and runs through January. The PCE inflation data was lower than expected on both the headline and core - but this was July data (and everyone is looking at food and energy at the moment...). It will be interesting to see the weekly Bloomberg Consumer Comfort data, which actually tipped off the weak Conference Board confidence survey from earlier this week.

An interesting data point that won't see much discussion was Canada's current account deficit lurching to near a modern low - this is critical stuff and shows what the strong CAD is doing to the Canadian economy. Imagine if we get a new reprieve in energy prices...stay tuned on that front as USDCAD continues to trade below parity.

Jackson Hole

I have joined the crowd in trumpeting tomorrow's Jackson Hole speech from Bernanke as a critical event for markets. But I think tomorrow may serve as more of a milestone rather than a specific catalyst because of anything specific that will be said tomorrow - my expectations are largely in line with what Steen discussed in his chronicle earlier today. The most likely scenario is an upgrade of "readiness to act" rhetoric with no real specifics save for a promise to keep rates low until late 2015, as if this makes any difference for those who can't, shouldn't or don't want to borrow money.

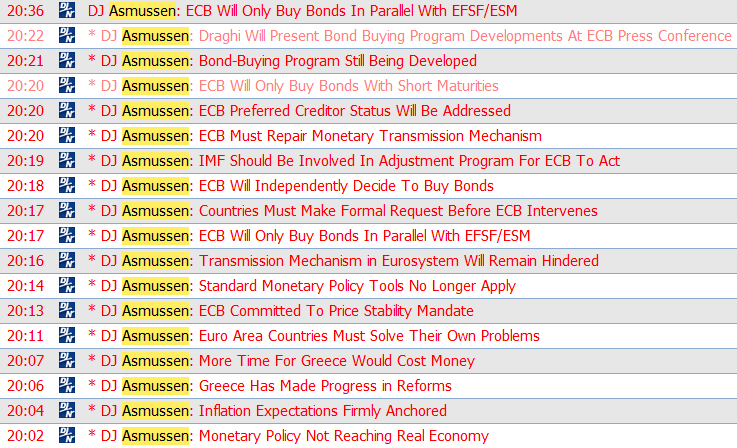

The bigger key here is what the markets begin to look forward to when they realize that a good deal of Fed easing was priced in a long time ago and that the more important considerations may lie ahead, like the uncertainty of the US presidential election and the fiscal cliff on the USA side of the Atlantic, and in the EU/ECB, etc. trajectory on this side of the Atlantic.

More tactically, the market has taken the edge off the latest extremes of complacency, so the tactical volatility (day to day) risks are more two sided in the wake of tomorrow's Bernanke speech than they were just a few days ago, at least in currency land. Recall that this weekend is a three day weekend in the US (labour day) and that tomorrow is also the last day of the month and the last day of the summer (or was that today...?).

So be careful out there.

najlepsze na końcu...